By Agrin Ayhan, Student at King’s College London

Let us investigate history to establish cause-effect relationships of empires that held the reserve currency status to understand better why I believe we are starting to see the collapse of the petrodollar system.

The information below comes from the book Principals for Dealing with a Changing World Order by Ray Dalio. The book is a macro-overview of previous empires that held global reserve currencies and what led to their downfalls. The following link contains all of the graphs that are shown below: https://www.economicprinciples.org/DalioChangingWorldOrderCharts.pdf

There are three important cycles to analyse:

- Long-Term Debt and Capital Markets Cycle; good and bad finances (e.g., the long-term debt and capital-markets cycle).

- Internal Order and Disorder Cycle; due to degrees of cooperation and fighting over wealth and power largely caused by wealth and value gaps.

- External Order and Disorder Cycle; due to degrees of the competitiveness of existing powers in fighting for wealth and power.

The archetypical big cycle:

- The rise: a period of building. When a country has a) low levels of indebtedness, b) small wealth, values, and political gaps between people, c) people working effectively together to produce prosperity, d) good education and infrastructure, e) strong and capable leadership, f) a peaceful world order that is guided by one or more dominant world powers, which leads to…

- The top: a period of excesses taking the form of a) high level of indebtedness, b) large wealth, values, and political gaps, c) declining education and infrastructure, d) conflicts between different classes of people within countries, e) struggles between countries as overextended empires are challenged by emerging rivals which leads too…

- The decline: a period of fighting and restructuring that leads to great conflicts and greater changes and the establishment of new internal and external orders, setting the stage for the next new order.

- New world order led by the new global superpower(s)

I will begin by discussing past empires that held global reserve currency status and finally conclude by linking it with my petrodollar argument.

The Dutch Empire and the Dutch Guilder

The Rise:

The Dutch Empire was built following the classical steps outlined above.

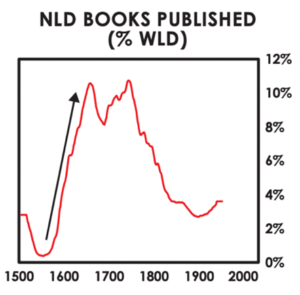

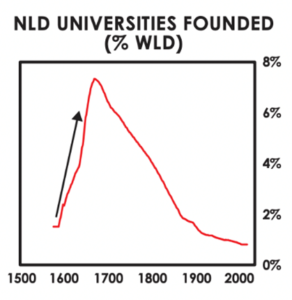

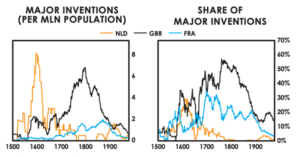

They created values and culture emphasizing saving, merit, and tolerance. They were an inventive society, and their openness to new ideas, people, and technology helped them rise quickly: They invented ships that could go around the world to collect riches and capitalism to finance these and other productive endeavors. They also created the world’s first mega-corporation, the Dutch East India Company (DEIC).

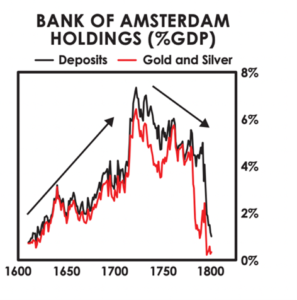

They created the world’s first reserve currency other than gold and silver, the Dutch guilder, supported by an innovative banking and currency system established by establishing the Bank of Amsterdam. Consequently, the Dutch became very rich. They continued to invest heavily in education and infrastructure to build on their success.

As a result, Amsterdam became the world’s most important financial centre.

The Top:

The Dutch Golden Age led the Dutch to shift their attention to “living the good life” in a way that weakened their finances. Other powers began to rise and challenge their rule. The arrival of capitalism, combined with the new approaches of the Enlightenment, led to an economic transformation called the Industrial Revolution centred in Britain.

At the top, the Dutch became too comfortable and saw a reversal of many of the classic ingredients to success. Their educational and technological edge eroded. They became uncompetitive via the decline of the DEIC.

In the 1700s, the Industrial Revolution led the British to overtake the Dutch, becoming Europe’s preeminent economic and financial power. The slowing down of economic growth made paying for and maintaining its vast empire more difficult. Increasing military conflicts (in attempts to protect their wealth) left the Dutch overextended and overindebted.

The Decline:

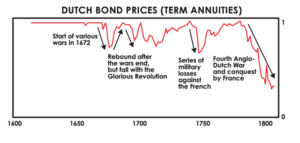

The Dutch a) became more indebted, b) experienced a lot of internal fighting over wealth, and c) weakened militarily. All this made them vulnerable to an attack.

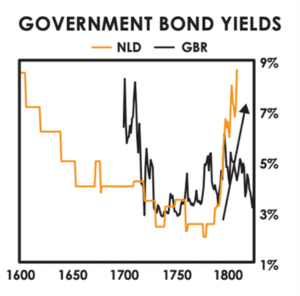

By 1750 the British and French became stronger than the Dutch, and wealthy Dutch savers started to move their cash into British investments due to their strong growth and higher yields.

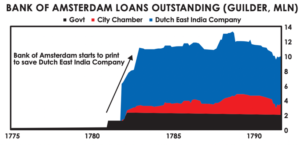

The Dutch losing trade routes and territories to the British caused a liquidity crisis. The DEIC had to borrow heavily from the Bank of Amsterdam to survive after the heavy blow its navy took from the British. The large debts and heavy losses led to the BoA printing more money to provide the DEIC with loans, where it soon became clear that there wasn’t enough silver and gold to cover all the paper claims on it, leading to a classic ‘run on the bank.’

Interest rates rose, and the BoA had to devalue its currency, undermining the credibility of the guilder as a store hold of wealth, leading to the decline of the Dutch guilder and empire.

The British Empire and the Pound Sterling

The Rise:

The British followed a similar, if not the same, trend as the Dutch. The replacement of the monarchy with the Commonwealth of England created a society where intellectual thoughts and debates flourished. There were higher investments in education (which caused literacy rates to rise) and the dissemination of ideas via printed materials.

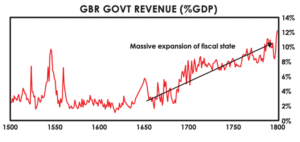

The creation of the Bank of England allowed the state to raise significantly more revenue than its international rivals. It also helped to standardize and increase the liquidity of the UK government debt, improving its ability to borrow.

The well-educated population, a culture of inventiveness, and the availability of capital to financially support new developments and ideas gave Britain a massive competitive edge.

The UK’s military strength allowed it to take over colonies and other European powers and secure its control over global trade routes. The profitability of the empire more than paid for its military spending because it supported economic activity.

Soon, London became the world’s financial centre and the pound sterling the world’s reserve currency.

The top

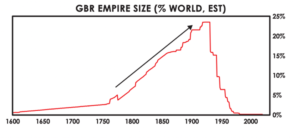

At Britain’s peak, with only 2.5% of the world’s population in the UK, the empire produced over 20% of the world’s income and controlled over 20% of the world’s land mass and over 25% of the global population.

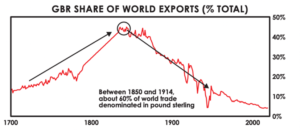

The UK’s share of global exports rose with the Industrial Revolution and the spread of the empire.

The decline

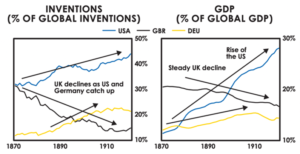

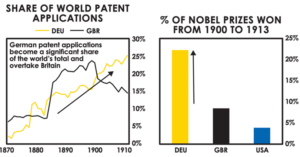

The final decades of the 19th century in Britain saw a) declining competitiveness, b) rising inequality and conflict, and c) the rise of new rivals (Germany and the US).

Britain couldn’t keep up with its rising rivals (US and Germany) during the Second Industrial Revolution. Their failure to reorganize its industries led to marked declines in output per worker relative to the other leading industrial powers (US and Germany). By 1900, the German GDP surpassed that of Britain.

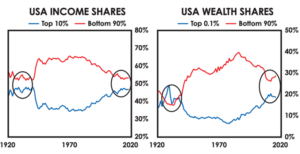

The gains from the Industrial Revolution were distributed unevenly. By the late 1800s, the top 1% of the population owned over 70% of all the wealth.

The UK faced challenges for influence abroad with France in Africa, Russia in the Middle East and Central Asia, and the US in the Americas. Its most significant rival was Germany.

The second world war produced a tremendous shift of wealth and power in the UK. The British were left with large debts, a vast empire that was too expensive to maintain, and a population with big wealth gaps that led to big political gaps. With overextension and overborrowing from its allies, the BoE was forced to devalue its currency and permanently suspend the pound’s convertibility into gold. With the signing of the Sterling Agreement in 1968, countries that continued to hold high shares of their reserves in pounds were holding de facto dollars, as the deal guaranteed 90% of sterling’s value in dollars, ending the reign of the British pound.

Are you seeing the trend?

For the end of the old and beginning of the new (eg Dutch to British, British to American) follow the steps:

- Debt Restructuring and debt crisis

- An internal revolution that leads to a large transfer of wealth from the “haves” to the “have nots.”

- External war

- Big currency breakdown

- New domestic and world order

The US dollar

The descent

With the Bretton Woods monetary system, the establishment of the IMF, World Bank, United Nations, and New York being the new global financial centre, the US cemented itself as the new global superpower that held the new global reserve currency status.

Banks increased their operations and lending in foreign markets. As a result, global lending boomed, and the stock market peaked in 1966. However, a) those who prospered overdid things by operating financially imprudently while b) global competition, especially from Germany and Japan, increased. As a result, American lending and America’s finances began to deteriorate as its trade surpluses disappeared. They started adopting a “guns and butter” fiscal policy with the space program and the Vietnam War, which proved detrimental to the state’s finances.

After the 1971 delinking of the dollar and other currencies from gold, the world moved to an unanchored fiat monetary system, and the dollar fell in value against gold and other currencies.

Throughout the long-term debt cycle (1945-2008), the Fed would lower interest rates and make money and credit more available to make the economy pick up, increasing stock and bond prices. That was how it was done until 2008 – ie., interest rates were cut, and debts were increased faster than income, creating an unsustainable bubble. That changed when the bubble burst in 2008, and interest rates hit 0%. This led the Fed to move to a monetary policy of printing money and buying financial assets. This enabled investment and corporate borrowers to purchase stock and assets, increasing prices and creating a larger wealth and income gap.

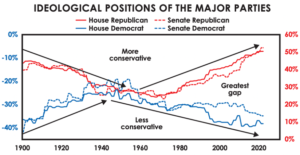

With Donald Trump’s election in 2016, he cut corporate taxes and ran big budget deficits that the Fed accommodated. While this debt growth financed relatively strong market-economy growth and created some improvements for lower-income earners, it was also accompanied by a further widening of the wealth and values gap. During his reign, the political gap grew with increasingly extreme Republicans and Democrats on each side.

In March 2020, the coronavirus pandemic hit, and incomes, employment, and economic activity plunged as the country went into lockdown. The US government took on a lot of debt to give people and companies a lot of money, and the Fed printed a lot of money and bought a lot of debt.

The Emergence of Rivals: a new global reserve currency

Russia and China have overtaken the US in gold reserves.

The table below, taken from the World Gold Council, shows the top owners of gold.

The Chinese gold figures are deceiving, showing China in 6th place with 2,010.51 tonnes in reserves.

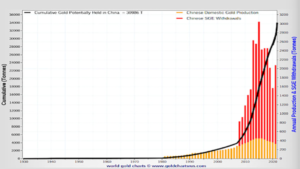

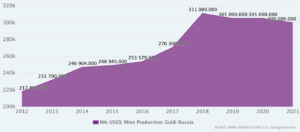

In 2007, China overtook South Africa as the world’s largest gold producer and has remained so. Over the last decade, they have produced 15% of all the gold mined worldwide.

Since 2000, China has mined roughly 6,830 tonnes. Over half of the Chinese gold production is state-owned. China also keeps the gold it mines as the export of domestic mine production is not allowed.

China’s gold imports are at their highest levels since 2018, increasing 64% year-on-year last year alone. According to Swiss customs (even though gold imports via Switzerland and Dubai are not always declared), the gold imported from Switzerland reached 524 tonnes (~$33 bn) in 2022. We also know that over 6,700 tonnes have entered the country since 2000 via Hong Kong alone. Adding this to the cumulative gold production since 2000, we reach a figure of over 13,500 tonnes.

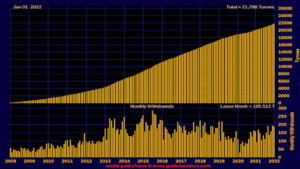

It isn’t easy to give an exact figure on Chinese gold reserves because only non-monetary gold (owned by the private sector) imports to China are publicly disclosed. And for the monetary gold (owned by the central bank), the President of the Shanghai Gold Exchange (SGE) Transaction Department said in an interview in 2014: The PBoC now buys gold through the SGE. However, we can use the numbers for SGE withdrawals to act as an approximation for demand. Since 2008, almost 22,000 tonnes have been withdrawn from the SGE.

Adding together all the cumulative production and private reserves i.e., billions, jewelry, imports, and existing stock, you get a figure of around 31,000 tonnes.

I believe China is being so discrete because they are trying to hint to the West that they are catching up and moving away from the dollar while also trying not to rock gold markets, as an increase in gold prices would not be an advantage to them. Chinese central bank governor Yi Gang echoed this in a press release.

Conversely, Russia has been stockpiling gold since the Western sanctions it faced for invading Crimea in 2014. Russia’s gold reserves went from 8.4% to 10.6%. In 2022 before it invaded Ukraine, this figure stood at around 20%.

Also note: Russia is the third largest gold miner, with an output of 330 tons annually (9% of the total gold mined globally). Recently, Russian companies have been expanding mining operations for gold in Sudan to increase their supply. While official gold exports from Sudan to Russia are minimal, some reporting suggests several dozen tons are shipped between the two countries yearly.

Dethroning the dollar

Why have Russia and China been stockpiling so much gold? The duo is a part of the BRICS group, which recently unveiled its plans to release a new gold-backed digital reserve currency to rival the dollar.

Excluding the (declining) geopolitical influence the US possesses, I believe that one of the main reasons the US dollar is still the reserve currency is the petrodollar agreement, which forces buyers to purchase oil using dollars.

Recent Saudi-US relations have been shaky. President Biden spoke of ‘re-evaluating relations with Riyadh’ and that there would be ‘consequences for their actions’ after OPECS’s decision in early October 2022 to cut oil production by 2mn barrels a day, roughly 2% of global consumption, despite lobbying from the US. The US stated they would stop selling weapons to Saudi Arabia, which violates the US side of the petrodollar agreement.

For BRICS to set a new reserve currency, they need to motivate other nations to use their currency. With Saudi Arabia and Iran restoring diplomatic relations (mediated by China) and both expressing an interest in joining BRICS, this is a massive win for the group; combined, Saudi Arabia and Iran produce over 15% of the world’s oil. Joining the group would also benefit the two countries, with China surpassing the US as the world’s largest oil importer, making a valuable trade ally for the OPEC nations. With Saudi Aramco recently acquiring 10% of a Chinese oil refiner, the two nations are starting to build a strong relationship.

Furthermore, we have recently seen the BRICS countries’ efforts to gain independence from the dollar. Vladimir Putin recently stated, “We are in favour of using the Chinese yuan for settlements between Russia and the countries of Asia, Africa, and Latin America.” Brazil and China have also reached a deal to trade in their currencies. This might be the leverage China sought to convince Saudi Arabia to replace the petrodollar agreement with a new petrobrics agreement.

Agrin Ayhan

Agrin is a second-year mathematics undergraduate student at King’s College London, graduating in 2024. Along with being on the university fencing and swimming team, Agrin enjoys researching commodities and natural resources. In his spare time, Agrin likes collecting Soviet-era classical vinyls and perfecting his method of pouring a pint of Guinness.

Just wanna remark on few general things, The website style and design is perfect, the subject material is really good : D.

That is really fascinating, You’re a very professional blogger. I’ve joined your feed and look forward to in the hunt for extra of your wonderful post. Also, I’ve shared your web site in my social networks!